In recent years, the world of Forex trading has been transformed by the advent of technology, especially through the use of automated trading systems or robot trading. These advanced systems allow traders to capitalize on market opportunities with minimal human intervention. For those looking to delve into this exciting realm, the tools and strategies available can be as intricate as they are empowering. For more information on trading methodologies, consider checking out robot trading forex FX Trading Broker.

Understanding Robot Trading

Robot trading, often referred to as algorithmic trading or automated trading, utilizes computer programs to execute trades on behalf of the trader. These systems analyze market data, execute buy and sell orders, and manage risks according to predetermined algorithms. The primary allure of robot trading is its ability to remove emotional factors from trading decisions, thereby enabling a more disciplined approach.

The Mechanics of Forex Robots

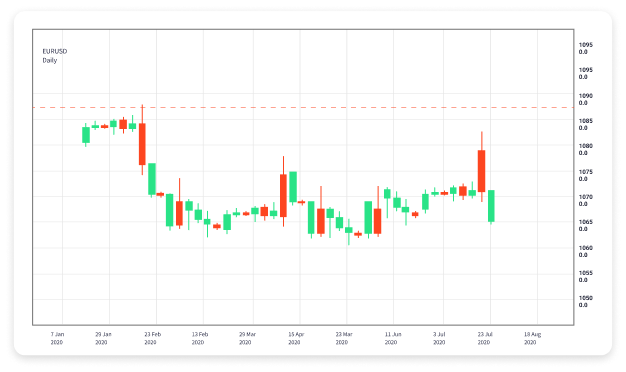

At the heart of robot trading lies sophisticated algorithms that can analyze price movements and trends in the Forex market. These robots are programmed to recognize specific patterns and conditions that align with the trader’s strategy. For example, a Forex robot might be designed to buy a currency pair when its moving average crosses above a certain threshold, or sell when it drops below another. The effectiveness of these robots depends on the quality of the code and the reliability of the data they process.

Advantages of Using Forex Trading Robots

There are numerous advantages to employing robot trading systems in Forex:

- 24/5 Market Monitoring: Forex markets operate 24 hours a day, five days a week. Robots can continuously monitor the market and execute trades even when the trader is not available, ensuring no opportunity is missed.

- Emotionless Trading: Human emotions can lead to poor decision-making. Robots operate purely on logic and parameters set by the trader, thus mitigating the risks of emotional trading.

- Backtesting Capabilities: Before deploying a Forex robot, traders can backtest their strategies on historical data to evaluate performance and make necessary adjustments.

- Efficiency: Robot trading can handle complex calculations and decision-making processes at speeds impossible for humans, providing a potential edge in the fast-moving Forex market.

Risks and Considerations

Despite the numerous advantages, it is crucial to recognize the risks associated with robot trading:

- Market Volatility: Forex markets can be highly volatile, and a poorly programmed robot can lead to substantial losses. It is essential to monitor the performance regularly.

- Dependence on Technology: A malfunction in the robot or a failure in the execution platform can result in delayed orders or missed opportunities. Traders must remain vigilant and be prepared for technology-related issues.

- Limited Flexibility: Forex robots operate based on predefined parameters and might struggle to adapt to sudden market changes or unprecedented events.

Steps to Get Started with Forex Robot Trading

For those interested in exploring the world of Forex robot trading, here are crucial steps to get started:

- Research and Selection: Begin by researching different robot trading systems available in the market. Read reviews and user experiences to determine which system aligns with your trading goals.

- Backtesting Strategies: Once you have selected a trading robot, backtest it using historical data. This step is vital in understanding how your robot might perform under different market conditions.

- Set Parameters: Configure the robot according to your trading preferences. This includes defining risk tolerance, trade size, and other relevant parameters.

- Start Small: Initially, consider using your robot with a demo account or by trading with a small amount of capital. This approach allows you to gauge the performance without risking significant funds.

- Monitor and Adjust: Regularly review your robot’s performance and make adjustments as necessary. The Forex market is dynamic, and it’s essential to refine your strategies accordingly.

Final Thoughts

Robot trading in Forex presents an exciting opportunity for both novice and experienced traders. By leveraging technology to automate trading decisions, individuals can enhance their efficiency and potentially increase profitability. However, as with any trading strategy, it’s crucial to understand the mechanics, advantages, and risks associated with robot trading. With careful research, testing, and monitoring, traders can unlock the potential of Forex robots and navigate the markets with increased confidence.